A tax invoice template is a legal document that a vendor submits to a customer which also includes information about General Sales Tax (GTS). Generally, this invoice is issued by a registered dealer to the purchaser which shows the amount of tax paid and payable. It further contains information about the tax registration identification number of the seller. Like a traditional invoice, it will include the word INVOICE and information about the issuing business. Moreover, it is also issued by the entities making a claim for input tax credit on creditable acquisitions. Moreover, it provides countless benefits for them and for their customers, like generating instant reports, advance tax-paid account details and tax-payable accounts.

Importance of Tax Invoice:

A tax invoice is an official slip which is generated by a business to inform the buyer about different costs of items, inclusive of taxes. Normally, it is used as a monitoring element of the transaction which records all essential information about a tax refund with respect to the amount of taxes. A tax invoice may usually include a set of information about the costs of products with general sales and withholding taxes. However, it will consist of the registered tax number of a business. Going further, companies can use tax invoices for creditable acquisitions. An individual business or company can maintain the accurate cost of sales data with the additional values as per tax statement.

Benefits of Tax Invoice:

A tax invoice helps customers to understand how much tax they will need to claim or deposit to the tax department during a specific period of time. Being a part of a business transaction, this invoice helps users to confirm whether their share of tax is paid or still payable. If it is not paid with the transaction, then understand the reasons for not including it. Furthermore, it makes sure how much a percentage of tax is included as per rules and regulations. The biggest benefit of using a tax invoice is to maintain financial records of a business smoothly and accurately. However, it is the right of a customer to know where his/her tax amount is deposited by the firm who is deducting it at source. Tax money is used by the government for taking beneficial steps for the country and its people. Going further, this invoice is beneficial in keeping track of those people or firms who don’t deposit the tax amount deducted at source. In case of non-compliance, these people or firms are fined by the tax department for not depositing tax money into the defined account of the income tax department.

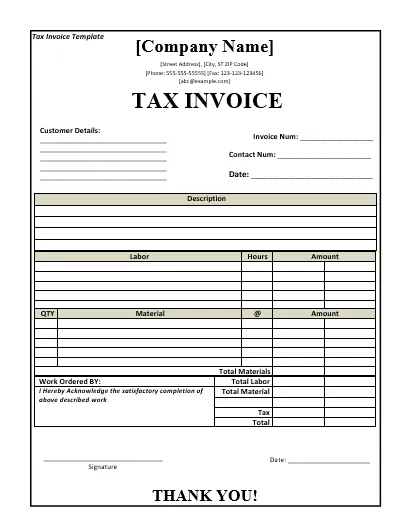

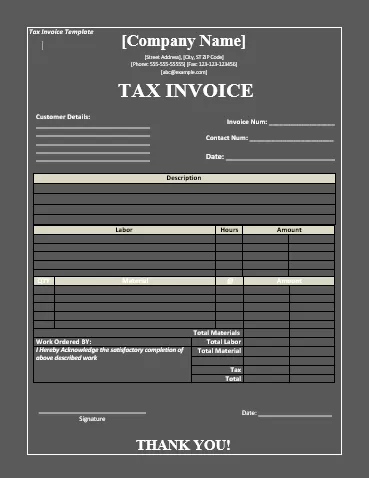

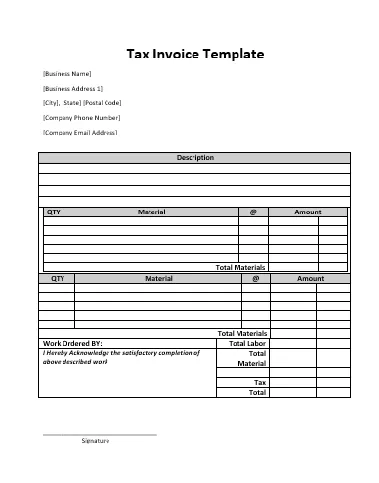

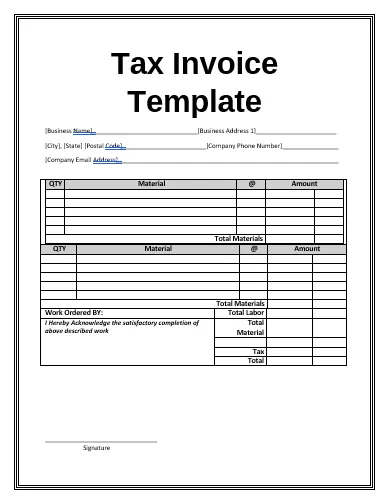

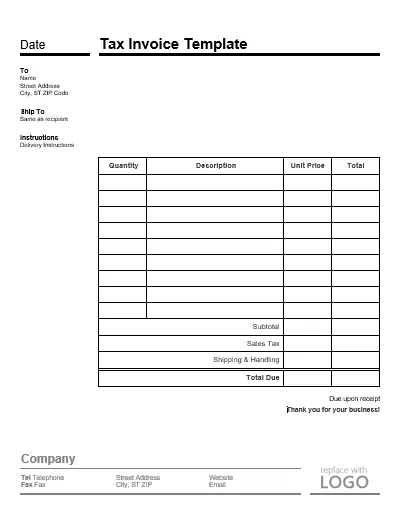

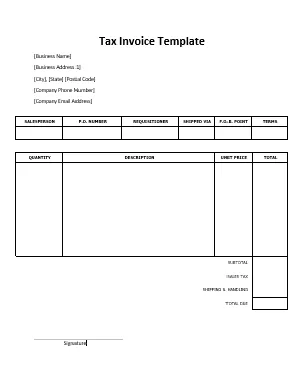

Details of Tax Invoice Template:

The tax invoice may be issued by the entities to make a claim for all the input tax credits with the history of the transaction. No doubt, a tax invoice template may support the company to build a collaborative system to keep an eye on transactions either made inclusive or exclusive of taxes. Moreover, they can attach this invoice to their accounting system to generate different reports. This way, the process of integration of tax information with their accounting system is possible. Going further, you can download all the templates that are provided on this page. This is because we have added them based on quality standards and the demand of our users.