A salary slip template is a formal document generally given by the manager to his employees when they are paid their salaries. This document also acts as evidence that an employee received the salary that has been made by the employer. A salary slip includes some basic information about an employee, such as his or her basic pay, taxes, pensions, allowances, and net amount paid. It additionally includes name of employee, designation, month of payment, date of payment, as well as the signature of the employer. Therefore, a salary slip format is a very crucial document because it can be presented as evidence to new employers. It also verifies that they have been paid that amount or proof of payment made in case of any dispute. Moreover, it is prepared by the employer and signed by an employee after receiving the salary. It is essential to issue a salary slip by the employer when salaries are paid.

Salary Slip and Its Dominance:

A salary slip unfolds indispensable information regarding salary as well as employment of an employee. Despite being generated every month or alternate fixed tenure, neither the importance nor the value of a salary slip is ignored. With the digitalization of technology, now there are software programs which generate a hard copy of a salary slip as soon as funds are transferred into an employee salary account. Furthermore, these software programs retain a soft copy of their database, which can further be used in preparing various financial reports. Since a salary slip is used in multiple ways, it must include an organization name and address. An employee can either use it to get financial assistance from a bank or can submit it as a job application in the open market.

Essential Components of a Salary Slip:

Being a legitimate proof of employment, a salary slip narrates different essential components from which vital information regarding employee, salary and employment is furnished. These modules are given in detail for better understanding of our users;

1- Basic Pay: A basic pay is the net amount which is provided to an employee without including any perk or allowance. As part of market practices, it comprises 40% to 50% of the net salary amount. Thus, it can vary as per circumstances and market practices. The calculation of perks and cash rewards is based on the basic pay amount.

2- Perks and Allowances: Perks and allowances are part of salary, provided by an employer to his/her employees to remain faithful and satisfied. Apart from the taxation point of view, these perks also play a very significant role in the preparation of financial reports. At this point, house rent allowance, dearness allowance, conveyance allowance and bonus are considered valuable perks.

3- Provident Fund: A provident fund is another feature of a salary slip which bears gigantic influence. Based on basic pay, it is calculated and diverted to another specific account with the name of the employee’s contribution. The part which an employee pays as a contribution to the Provident fund is totally exempted from tax.

4- Taxation: There are different taxes levied on the salary amount of an employee, if it exceeds up to a defined amount monthly or annually. The most crucial tax which an employee is paid in salary is called advance tax. It is deducted at source by employers on the instructions of the income tax authorities. Later, it is deposited into the taxation account of a business or an organization, enabling employees to claim it while filing their personal income tax assessment. There are other taxes which are applicable on salary, which are; professional tax, tax on bonus amount and any other tax as proposed by the income tax department.

Benefits of Salary Slip Template:

A precise salary slip is used for different purposes, but the main objective is to keep it as evidence. It records the facts related to the salary, such as; tax paid, basic pay, insurance statement, deductions, security deposits, utility charges, date and month, employee and employer signatures. If the employee blames the employer for repaying the salary, then this salary slip will protect the employer as proof which explains that the employer has made the payments for salary through check or cash on a specific date. Thus, the salary slip or salary certificate will help the employee to rent an apartment for residency or apply for a bank loan. This salary slip template helps you with making a perfect and unique format for your business or shop. You can make the necessary changes because our motive is to provide you with a format which can make you comfortable.

Templates for Salary Slip:

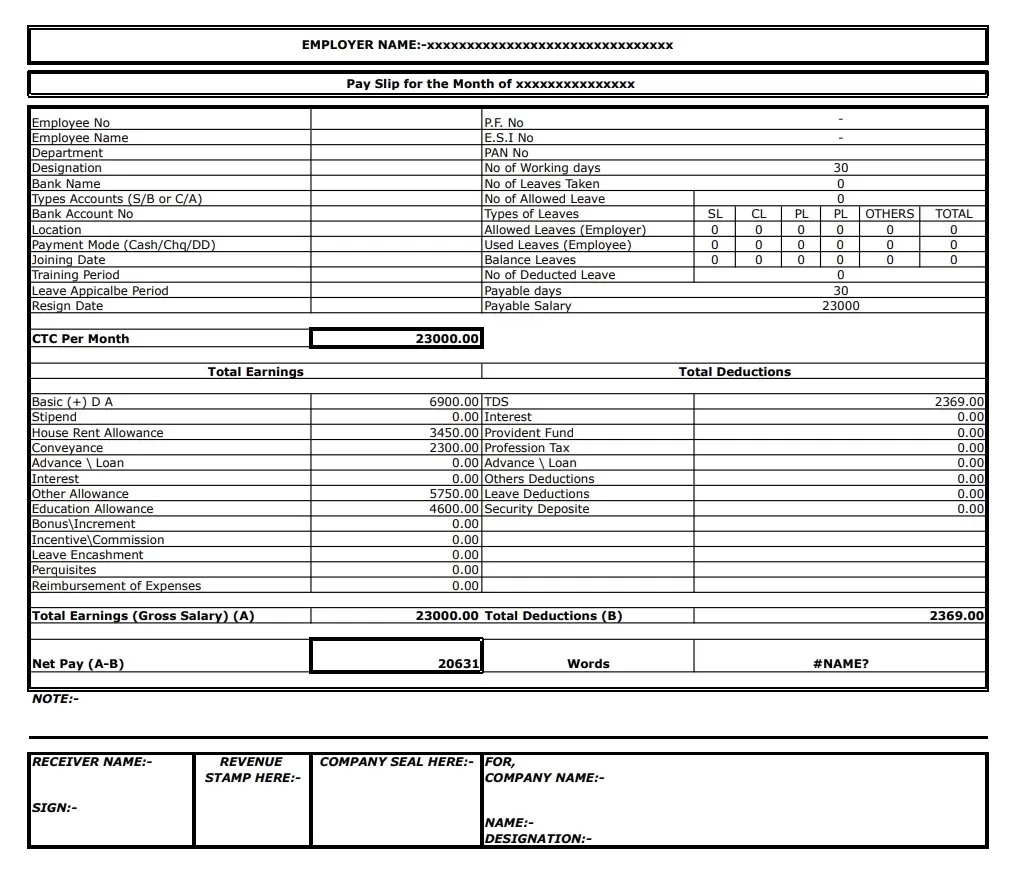

devlegalsimpli.blob.core.windows.net

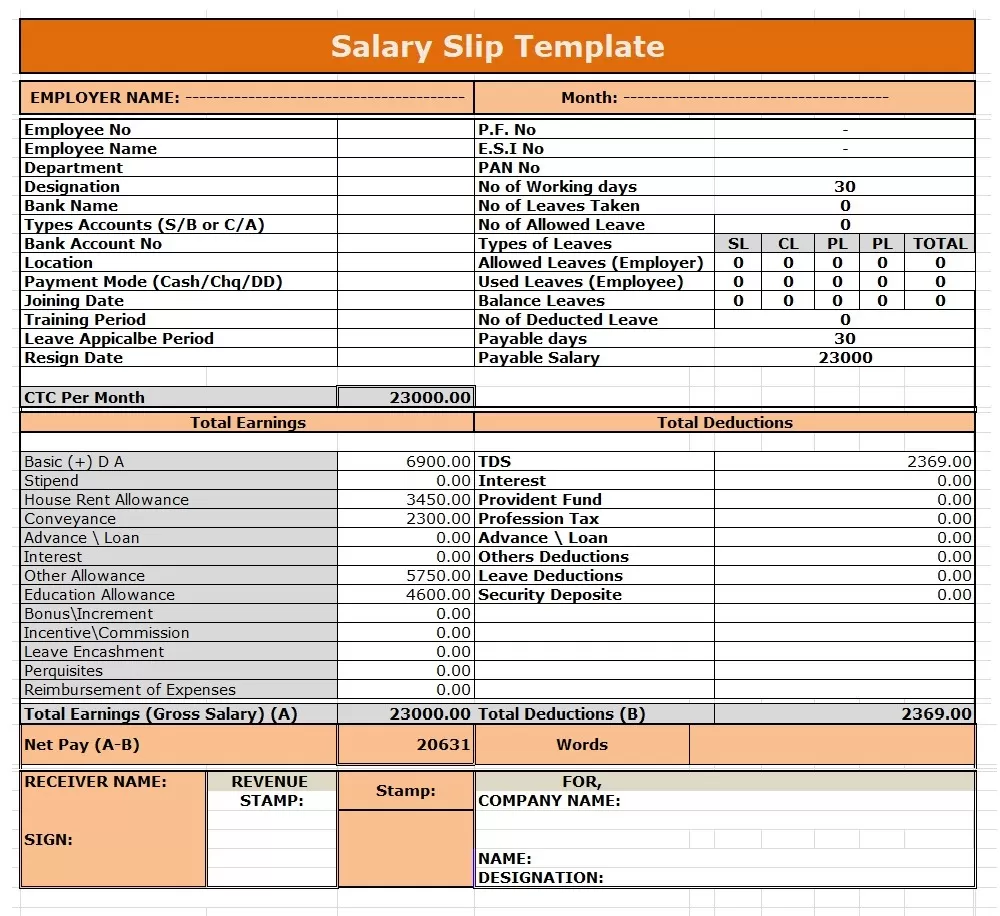

devlegalsimpli.blob.core.windows.net

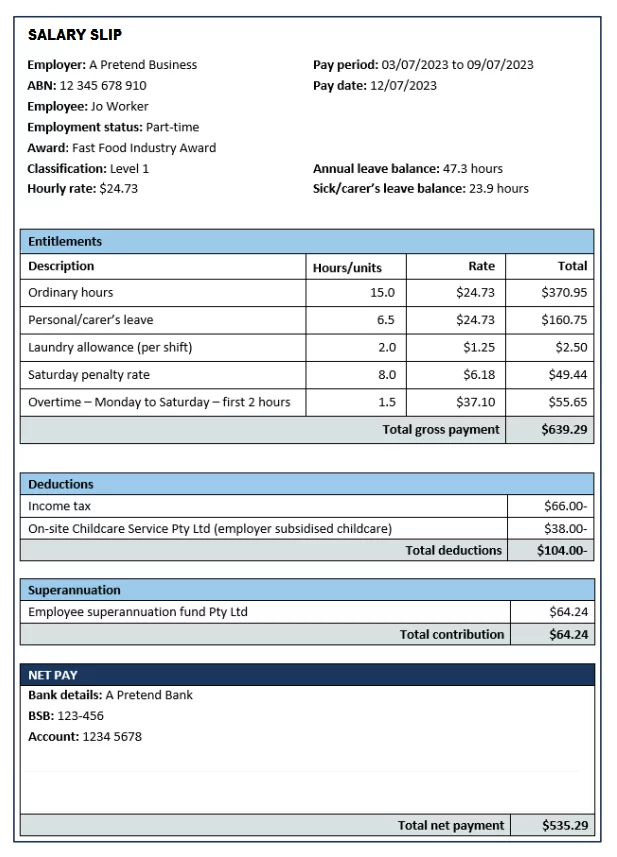

www.fairwork.gov.au

www.fairwork.gov.au

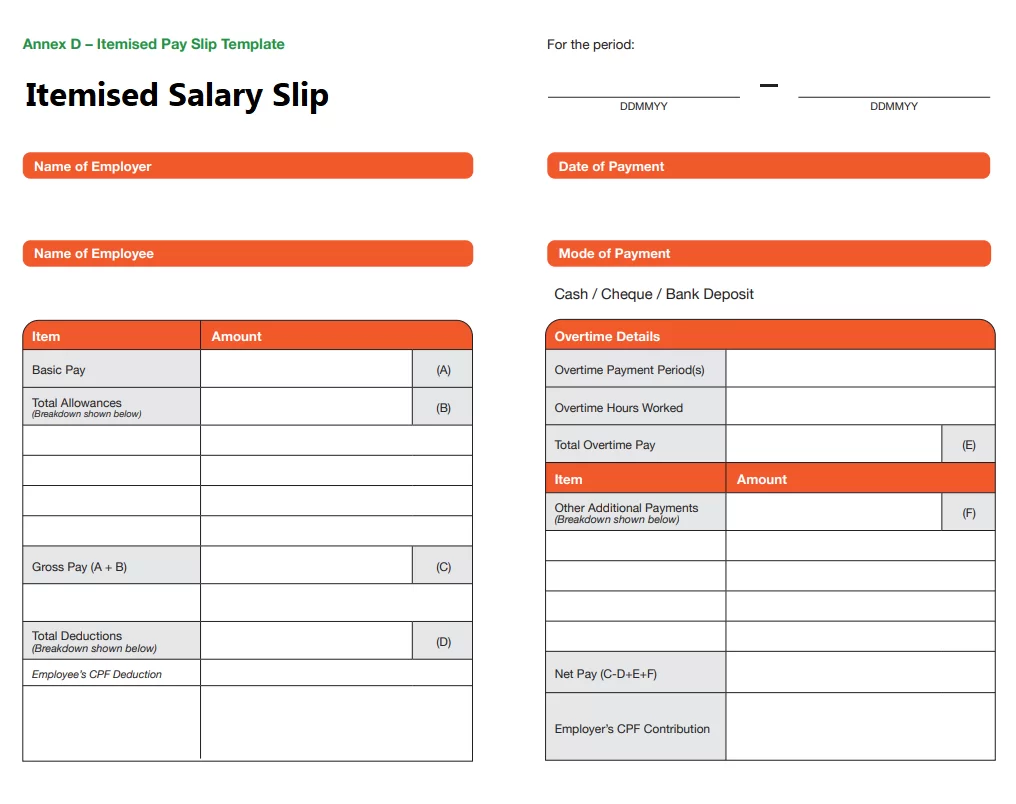

www.mom.gov.sg

www.mom.gov.sg