A financial statement template is a formal document that outlines the financial activities and position of a business, individual or any other entity. Usually, these statements are big players in the world of accounting and quantify the financial strength, performance or liquidity of an organization. Moreover, people use them to reflect the financial effects of business transactions and activities on the entity or individual. Generally, the financial reports are prepared by the company’s managers to represent the financial performance and position at a point in time. Going further, the financial statement template is the basic source of financial information not only for the public but also for most decision-makers.

Importance of Financial Statement:

With the help of a financial statement, the management of a company can check the status and performance of financial accounts. Truly, from the value of view, this statement provides a bit of information with respect to the financial value of the company. Moreover, it equally helps the investors and creditors to evaluate the financial performance of a company. Going further, a financial statement helps the business to communicate with other entities or interested parties who are willing to learn about the latest financial position of the company. This way, they can utilize this information before making any investment-related decisions.

What Benefits Stakeholders Can Avail From Financial Statement?

The financial statement is beneficial for the public and shareholders. This is because it provides a lot of information about the financial strength of a company. For instance, after tax earnings, gross and net expenses, gross profit, current and long term liabilities and tangible and non-tangible assets. Financial information is the key and being the financial face of an organization, a financial statement helps shareholders and stakeholders with how to manage their relationships with them. When the ratio of liquidity and solvency is found in financial statements, it helps the shareholders to see the ability of the company to repay its debts and expenses. Going further, it is also used by them to compare the result of the previous year or any competitor of the company.

Connected Statements with a Financial Statement:

In point of view of the general scenario, there are different types of financial statements that fully focus on diverse areas of financial performance. Moreover, these statements are used for operating results of the company, some for financial conditions, some for cash flow and others for shareholder’s equity. As per market practice, the following statements are connected with a financial statement. These are known as:

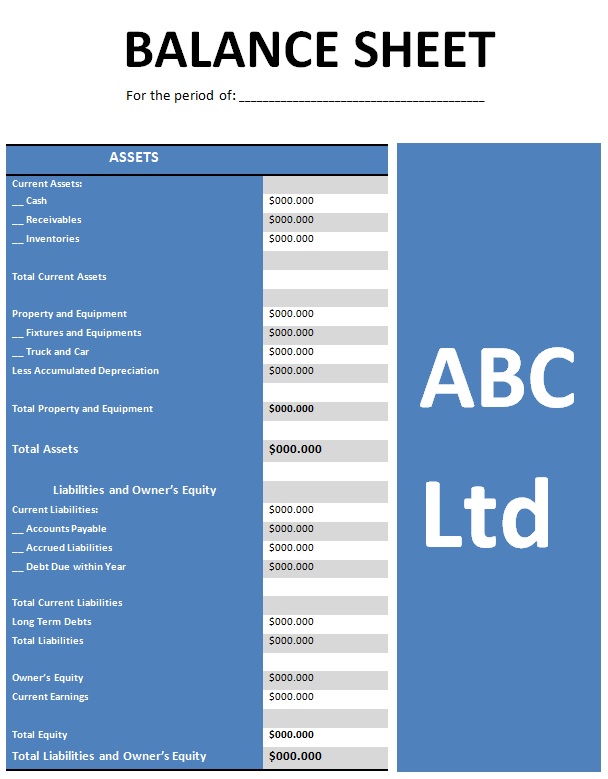

Balance Sheet:

A balance sheet reflects the financial position of a company on a specific day.

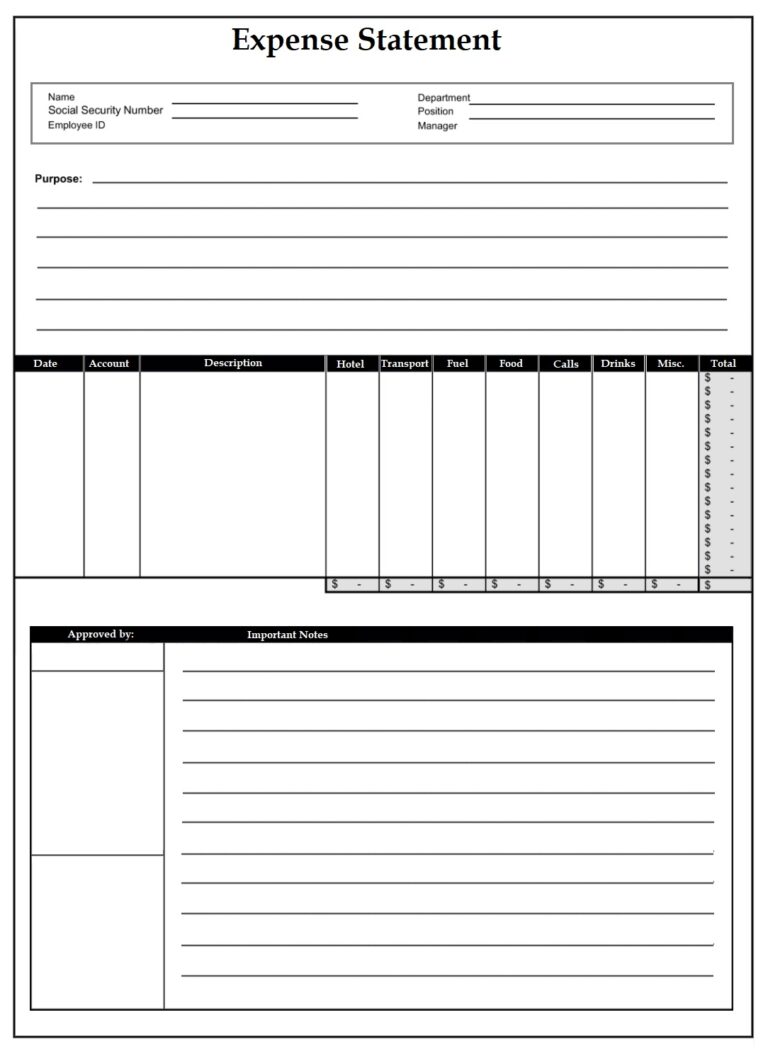

Financial Expenses Sheet:

A financial expenses sheet covers those areas where a company has made significant expenses, either for future earnings or for maintenance.

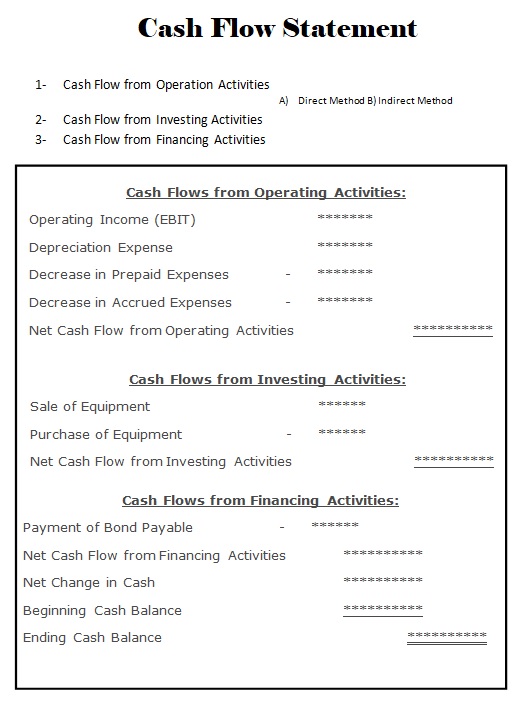

Cash Flow Statement:

A cash flow statement defines how the cash balance at the start of the financial year is used to meet expenses during a specific period. It also includes those transactions where a company received cash.

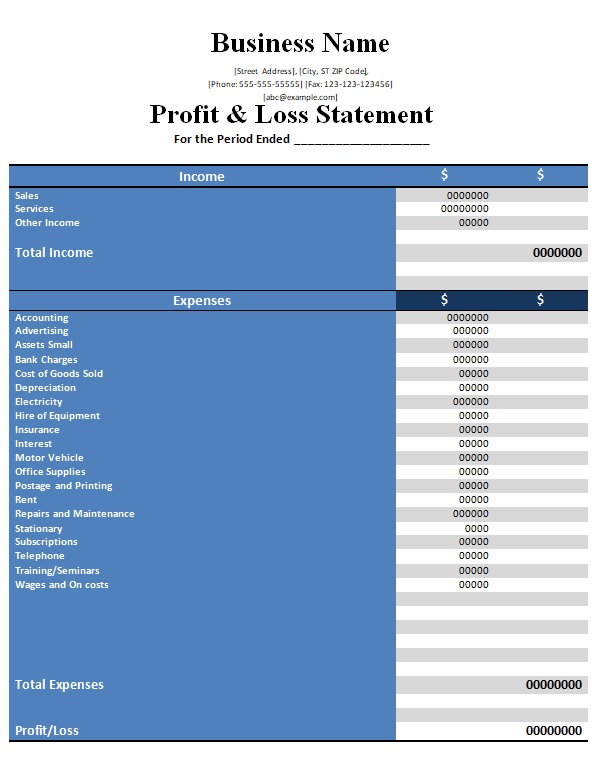

Profit and Loss Statement:

This statement reflects an overall picture of a company where anyone can see what the company invested in business (equity) and how much they earned (profit) after bearing yearly expenses.

Annual Reports:

Annual reports are also included in a financial statement which supports the facts and figures. These are usually attached as important notes or supporting statements in the bottom area of a financial statement.