A credit reminder template is a legal document which might be sent to the debtors to remind them that their payments are still payable as well as the due date is gone or about to come. It is written by business individuals who are dealing with the creditors of the business. Moreover, it is composed of keeping all essentials of business writing in mind. A credit reminder can be printed on a simple white paper or on the company letterhead, depending on the company’s requirements. This document includes entire information about the amount due from the customers. It would be very wise to use a positive tone throughout the letter with a friendly request, to make their remaining account balance clear as well as enhance the business relationship with them. The wording should also reflect the same meaning, such as; it is only a reminder letter with the aim of requesting you to clear the balance before or till the ending date as agreed in a business agreement. However, if a client has already made the payment, then it insists him/her simply ignore this reminder.

Importance of Credit Reminder:

For better optimize opportunities to claim your outstanding dues, a system of sending reminders with soft or, sometimes, hard messages is inevitable. The purpose of sending a credit reminder message is nothing except giving a reminder call. However, it becomes the duty of the receiver to answer your call by explaining the reasons for the delay in payment, if it happened. The credit reminder letter is very crucial in business to prevent future inconveniences due to delays in payments. A few changes in format can make this format effective in all prospects. This reminder can be defined as an official document prepared and sent by the credit card company to the doorstep of their credit card holders as a reminder for their due payments. Basically, the main objective is to remind your debtors that they must have to make payments within specific dates. This is because there is still the amount which is due, and the last date is about to come. Well, such a reminder may also be sent when the due date for payments is gone.

Benefits of Credit Reminder:

There are certain crucial components which are needed to handle with care while writing a credit reminder letter. The task of writing a credit reminder letter is not a simple or easy task, as it requires professionalism and special skills. The best way to convey your message in a very appropriate tone is the biggest benefit of this letter. The client, who is not paying the outstanding amount, must understand the significance of the value of money that is being on hold due to delay in payment. Nevertheless, this reminder must ensure their business relationship as the “most significant aspect”, and being a business partner, you are willing to continue these terms in future as well. The idea of getting very aggressive or confrontational upon not receiving payments on due dates, can not only put your relationships with other partners at stake, but also can jeopardize the chances of getting the remaining amount without legal action. However, becoming too polite or courteous can also make it hard to collect the remaining amount. The tone and the meaning of your words is your weapon, therefore use them wisely and sensibly.

Why to use a Credit Reminder Letter?

A credit reminder letter has great significant worth in any business. It aims to secure the smooth continuity of business relationships with other businesses by preventing them from future inconveniences that could happen due to delay in payments. For this purpose, you can add more options or can offer different payment options to your clients who are facing trouble with making payments on time. These options can be considered very encouraging as they give multiple options to the clients. For instance, a time period or delay in due date, installment option or adding a markup for a longer period of time gap. The approach which you should keep in mind is to avoid getting into litigation. The legal course of actions requires more time and funds, which will ultimately put a bad name on your organization.

Templates for Credit Reminder

www.profcoll.com.au

www.profcoll.com.au

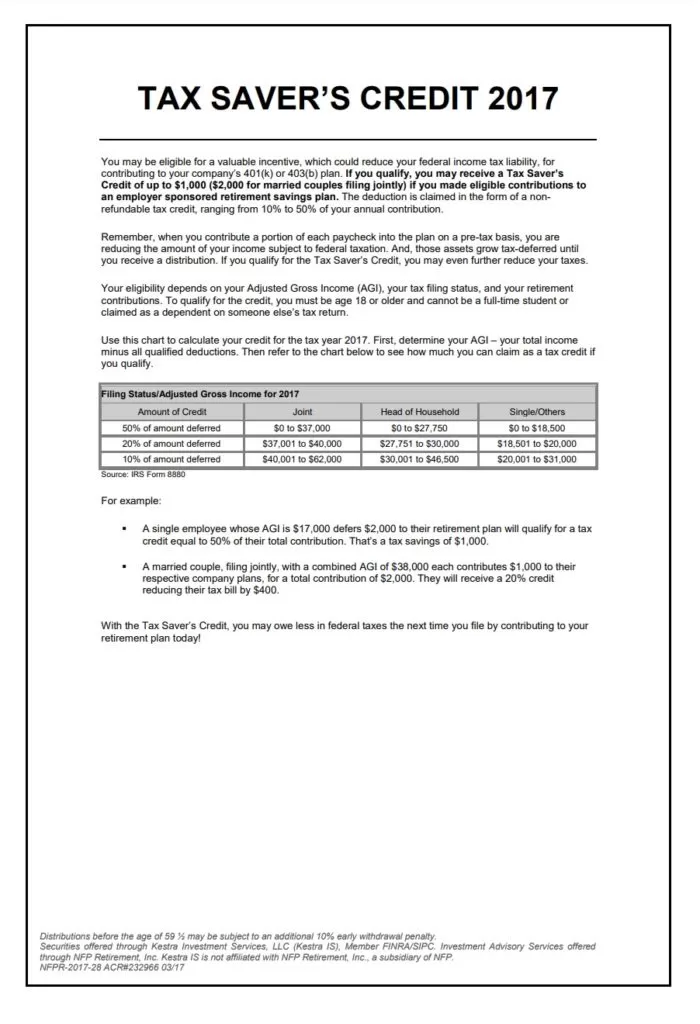

www.schneiderdowns.com

www.schneiderdowns.com

www.aghost.net

www.aghost.net