The purpose of sharing a certificate of liability insurance template with you, is to give you a bird-eye view of the real certificate. Whereas; a certificate of liability insurance is basically used to prove that you and your business have coverage i.e., insurance up to a certain period. It is important to have a certificate which can help you while filing a claim or to attract investors. In order to get one, you need to buy a business liability insurance policy, and depending on your choice of the insurance provider, this certificate is delivered to your home, or you have to request one from your policyholder. A liability insurance provide coverage for all business activities especially for a large-scale project which is started by either an individual or through the collaboration where two different companies come together on a single project. It is a very popular risk-management technique used by contractors for large scale projects. This insurance enables them to reduce the total construction cost, in case of loss and mitigates the possible risk scope.

The Significance of Liability Insurance Certificate

A liability insurance certificate holds colossal importance not only for business entities but also for individuals. The cost of liability insurance depends on a variety of factors. Whereas, a basic amount is required in the case of a small business. On the other hand, more insurance coverage may be required, when working on a large-scale project. The size of your company is the key factor that decides the extent, along with work nature, number of employees, your payroll expenses, and the specific services provided by your business. In some cases, your state policies also have some requirements depending on your location and the kind of business you do.

Information on the certificate of liability insurance

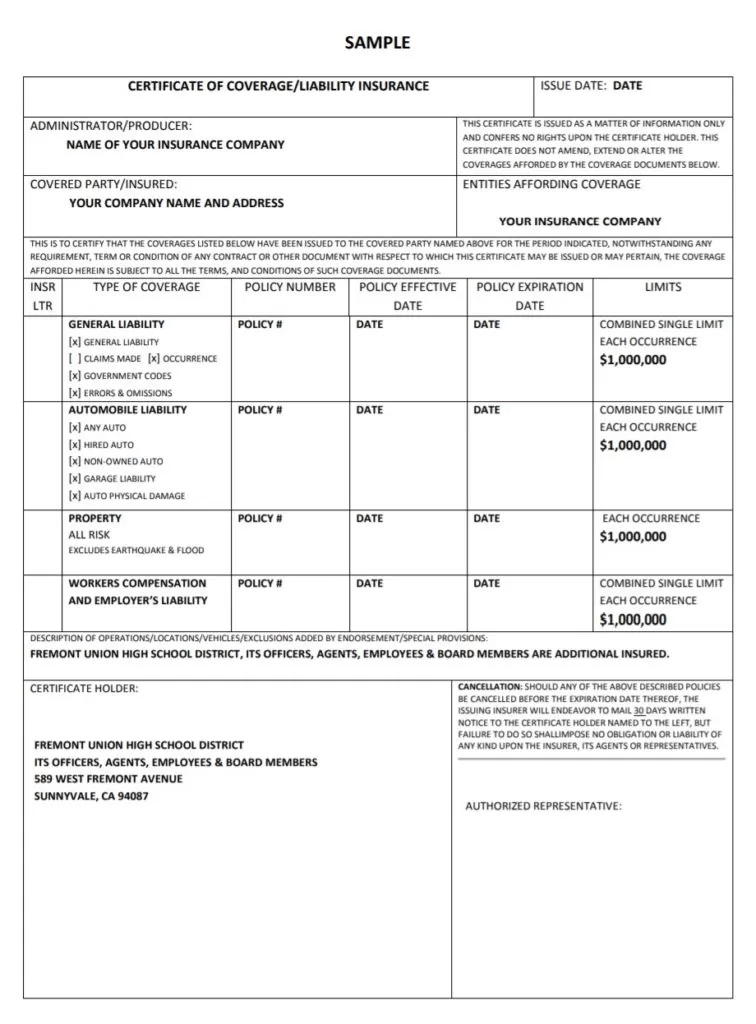

It is a tricky document as it comprises a single page and a great deal of information is found on it which includes:

• Name/Address of the insured: The information of your business must match with the details you provided while registering your business. The company name should also match the name you gave to the party requesting it if you want your request to be approved.

• Contact information of the broker: This information is provided in case the reader wants to verify the coverage by contacting your broker.

• Details: All the details of the insurance company.

• Coverage Information: it includes details of provided coverage and its types.

• Operation description

• Information of the certificate holder

Damages covered by Liability Insurance Certificate

Noteworthy, while calculating damage loss, only minor expenses are covered by the insurance company. At initial level, the insurance company checks the feasibility of the project and then provides insurance coverage accordingly. The expenses, as a result of any mishap during the project or the damages caused due to any lawsuit, are covered by liability insurance. Nevertheless, this policy also has its own limitations. This insurance doesn’t cover the expenses of the following including many more.

• Injuries caused to the employers.

• Accidents of working vehicles.

• Exemplary damages.

• Intended mistakes.

Advantages of possessing Liability Insurance Certificate

The right amount of liability insurance is important for the protection of business, but it is also highly beneficial for the growth of your business. Other benefits include:

• Accidents happen all the time even when you think everything is under control so the most obvious benefit of possessing this insurance is that it will secure you against the unexpected.

• Many large firms require coverage if you want to confirm any deal, so having insurance can aid in closing more deals.

• It is a source of customer satisfaction as they feel a lot more comfortable working with the companies having insurance therefore allowing you to work on better projects.

• It helps in the process of decision-making. For instance, the insurance will help you decide whether you should invest more amount in the project.

Templates for Liability Insurance Certificate

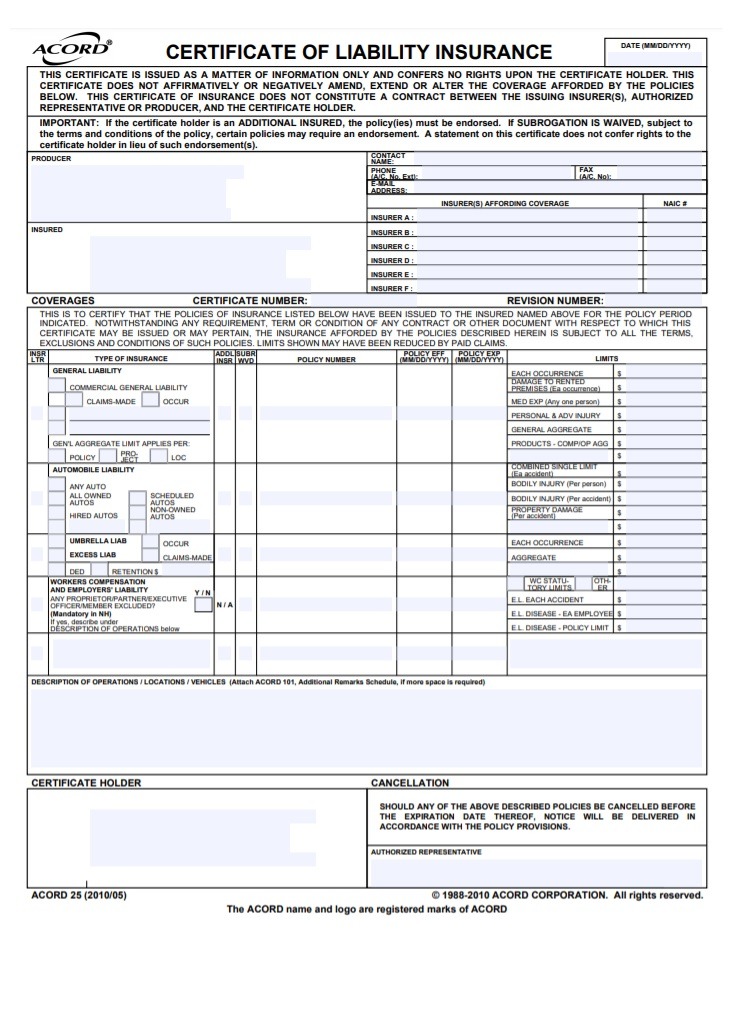

cel.sfsu.edu

cel.sfsu.edu

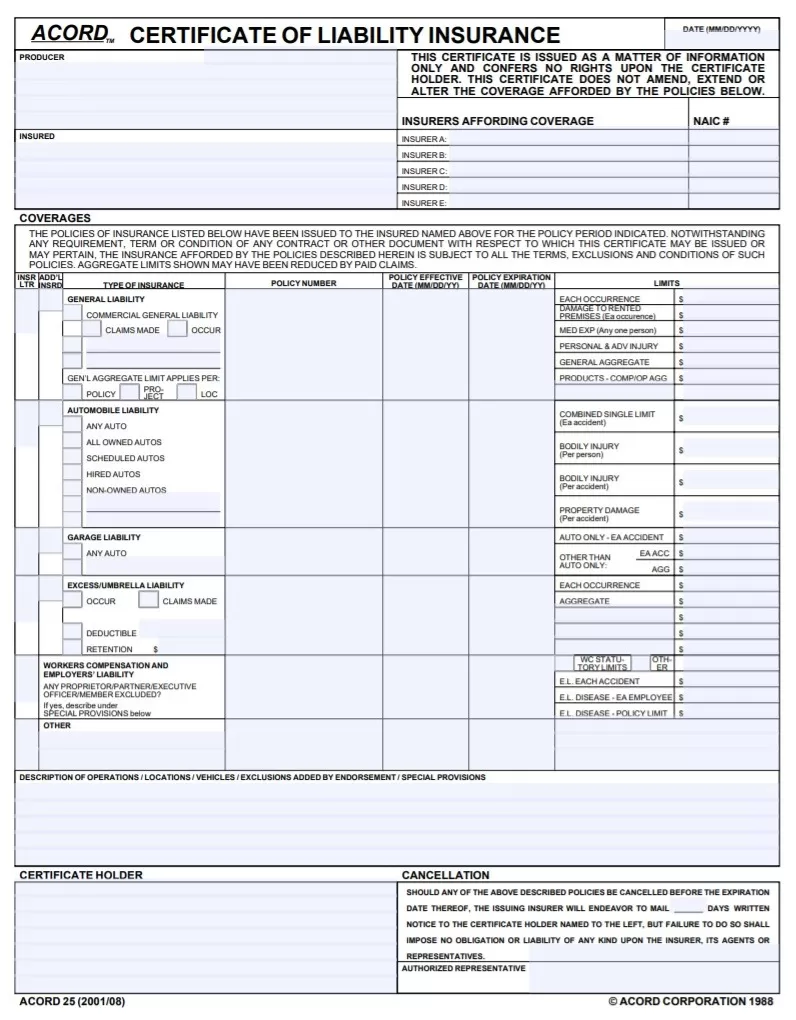

www.cmsrisk.com

www.cmsrisk.com

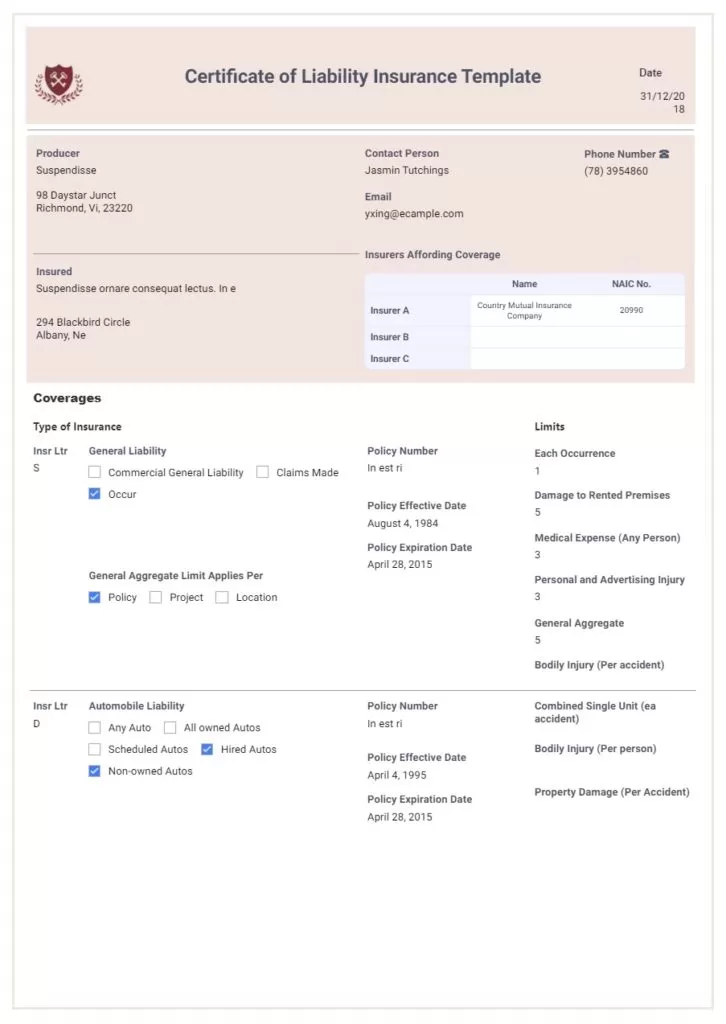

www.jotform.com

www.jotform.comLimitation of Liability Insurance Certificate

Apart from advantages of having certificate of liability insurance, there are some limitation which this certificate cannot fulfil. These are given below for your comfort;

• Immovable Asset damage: The purpose of this certificate is loud and clear. A loss of property due to repairing or changing or selling in loss cannot be payoff with this insurance. There are other kinds of insurance policies which can provide shelter for such losses but not this certificate.

• Shutdown Period damage: When a business is forced to stop due to any reason, its fixed expenses like salary, rent and storage can be leverage through insurance but the loss of income during this phrase cannot be offset through this certificate.

More Templates

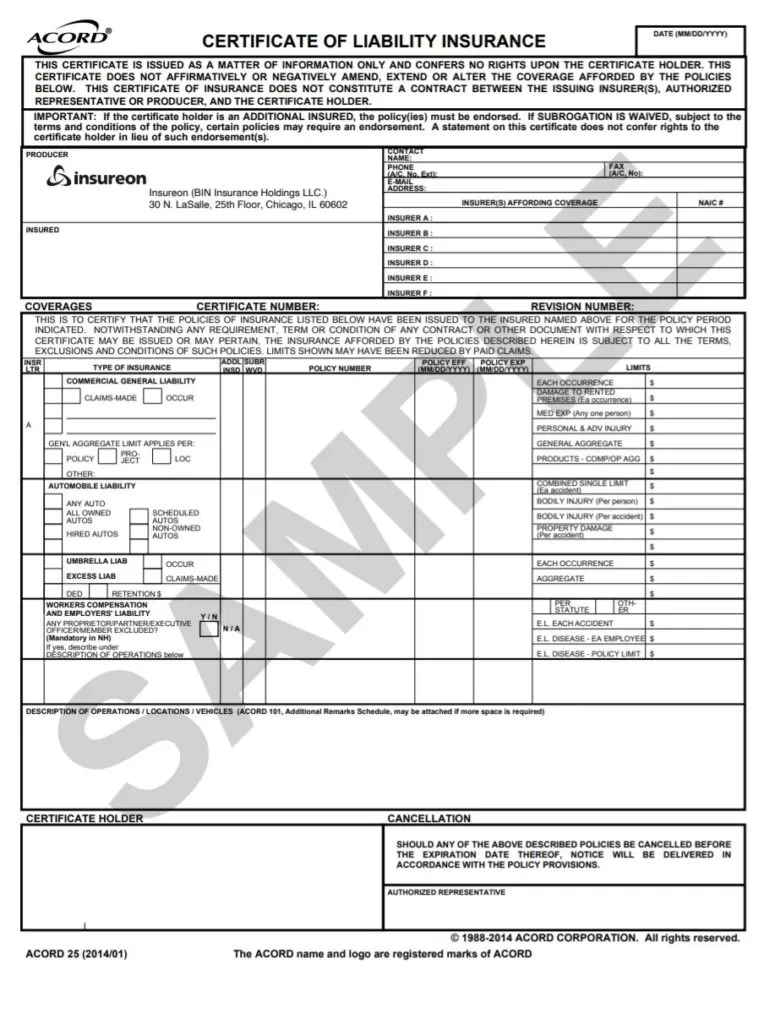

www.insureon.com

www.insureon.com

resources.finalsite.net

resources.finalsite.net

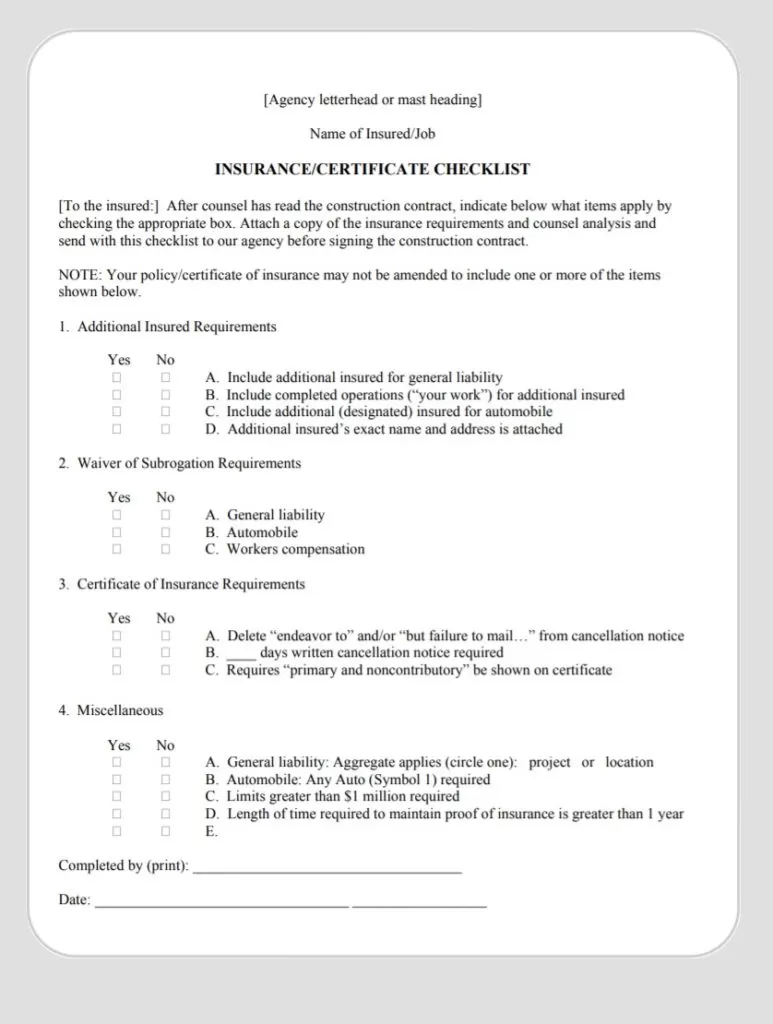

www.independentagent.com

www.independentagent.com

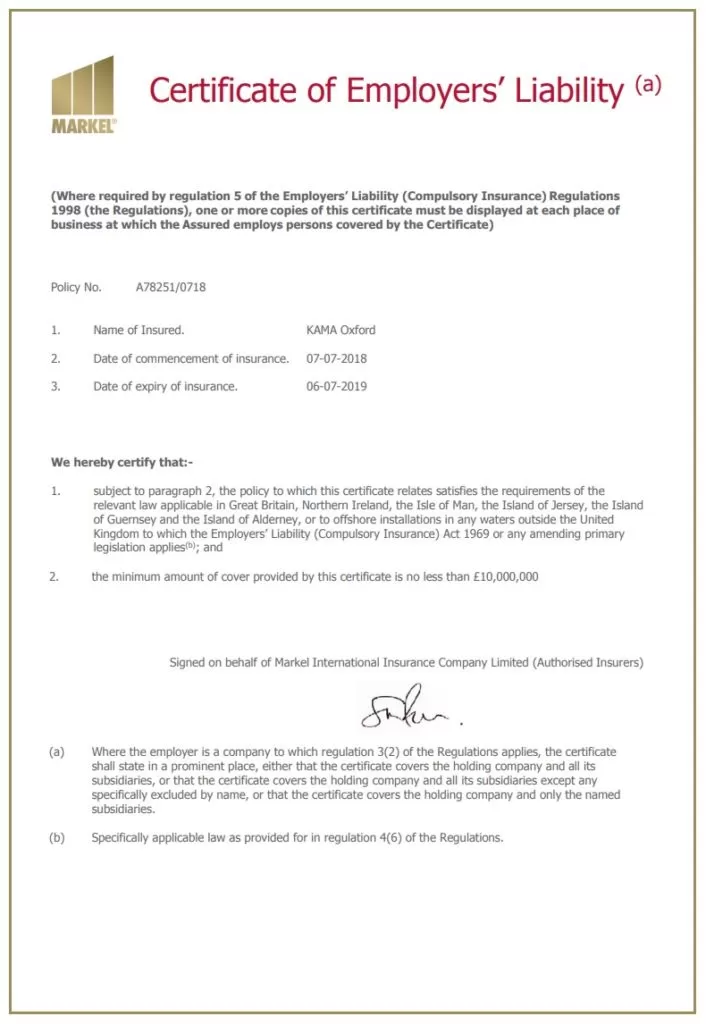

www.kamaoxford.org.uk

www.kamaoxford.org.uk